NYC Property Taxes: What You MUST Know!

Understanding NYC property taxes can feel overwhelming, but it's crucial for every homeowner. The NYC Department of Finance, the primary entity responsible for assessment, sets the property values. Tax Classifications, designating different property types, directly influence the tax rate. Property Assessment plays a pivotal role in determining your tax bill. Property Tax Bills are influenced by these factors, so understanding them helps you. Knowing how the NYC Department of Finance handles nyc dept of finance property taxes ensures fair compliance and helps you navigate the complexities.

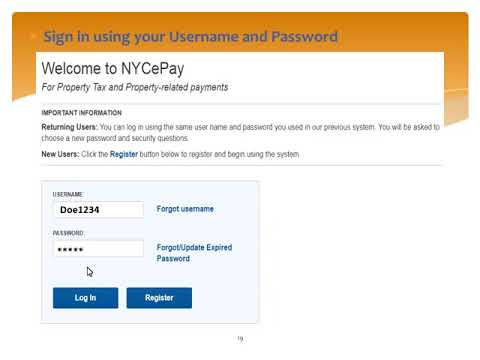

Image taken from the YouTube channel NYC Department of Finance , from the video titled How Do I Get Help Understanding My Property Tax Bill? .

NYC Property Taxes: Unlocking What You MUST Know!

Navigating NYC property taxes can seem like a daunting task. This guide simplifies the process, focusing on what you absolutely need to know, with special attention paid to the NYC Department of Finance (DOF) and its crucial role.

Understanding the Basics of NYC Property Taxes

What Are Property Taxes and Why Do We Pay Them?

Property taxes are a primary source of revenue for New York City, funding essential services like schools, sanitation, police, and fire departments. These taxes are levied on real property, including land, buildings, and improvements to those properties.

Who Pays Property Taxes?

Essentially, anyone who owns property in NYC is responsible for paying property taxes. This includes homeowners, landlords, and commercial property owners. Renters indirectly contribute through their rent payments, as landlords factor property taxes into their rental rates.

The NYC Department of Finance (DOF): Your Go-To Resource

The NYC Department of Finance (DOF) is the city agency responsible for assessing property values and collecting property taxes. They are your primary point of contact for questions, payments, and understanding your assessment. Familiarize yourself with their website; it is an invaluable resource. The main keyword "nyc dept of finance property taxes" will consistently direct users to the DOF website.

Decoding Your Property Tax Bill

Understanding the Assessment Process

The DOF assesses the value of each property annually. This assessment, also known as the assessed value, is not necessarily the same as the market value (what you could sell the property for). It’s used to calculate your property tax bill. Factors considered include location, size, condition, and zoning regulations.

Key Components of a Property Tax Bill

Your property tax bill includes several key components:

- Assessed Value: The value assigned to your property by the DOF.

- Tax Rate: A percentage determined by the City Council to calculate the tax liability. Tax rates vary based on property class.

- Exemptions and Abatements: Reductions in your tax liability for qualifying reasons (e.g., STAR, senior citizen exemptions, coop/condo abatements).

- Taxable Value: The assessed value minus any exemptions or abatements.

- Total Property Tax: The amount you owe, calculated by multiplying the taxable value by the tax rate.

Finding Your Property Tax Bill Online

The easiest way to access your property tax bill is through the DOF website. You can search by address, borough, block, and lot number. This allows you to view your bill, payment history, and assessment information related to "nyc dept of finance property taxes".

Property Classifications: What Group Are You In?

NYC properties are divided into four classes, each taxed at a different rate:

- Class 1: Primarily 1, 2, and 3-family homes.

- Class 2: Primarily residential buildings with more than three units, including co-ops and condos.

- Class 3: Utility properties.

- Class 4: Primarily commercial properties.

Knowing your property class is essential for understanding your tax rate and eligibility for certain exemptions.

Exploring Exemptions and Abatements

Common Exemptions and Abatements

NYC offers several exemptions and abatements that can significantly reduce your property tax bill.

Here's a table highlighting some common examples:

| Exemption/Abatement | Description | Eligibility |

|---|---|---|

| STAR (School Tax Relief) | Reduces school taxes for eligible homeowners. | Primarily for owner-occupied primary residences. |

| Senior Citizen Homeowners' Exemption | Reduces property taxes for eligible senior citizen homeowners. | Age and income restrictions apply. |

| Coop/Condo Abatement | Reduces property taxes for cooperative and condominium owners. | Must reside in the cooperative or condominium. |

| J-51 | Provides tax benefits for improvements to residential buildings. | Requires specific types of renovations/improvements. |

How to Apply for Exemptions

The application process for each exemption varies. Check the NYC DOF website and search using "nyc dept of finance property taxes exemptions" for detailed instructions and required documentation. Deadlines are crucial.

Understanding Tax Rates

How Property Tax Rates Are Determined

The NYC City Council determines property tax rates annually. These rates are based on the city's budgetary needs and the total assessed value of all properties. Rates differ across the four property classes, with Class 1 generally having the lowest rate and Class 4 the highest.

Finding Current Tax Rates

Current tax rates are published by the NYC DOF. Visit their website and use the search terms "nyc dept of finance property taxes rates" to find the most up-to-date information.

Paying Your Property Taxes

Payment Options

The DOF offers various payment methods:

- Online: Through the DOF website.

- By Mail: Using a check or money order.

- In Person: At designated DOF locations.

- Direct Debit: Automatic payments from your bank account.

Payment Due Dates

Property tax bills are typically issued twice a year. Missing payment deadlines can result in penalties and interest charges. Check your bill or the DOF website for specific due dates.

What Happens If You Don't Pay?

Failure to pay property taxes can have serious consequences, including liens on your property and, ultimately, foreclosure. Contact the DOF immediately if you are struggling to pay your taxes to explore available payment plans or assistance programs. You can search the NYC DOF website for "nyc dept of finance property taxes payment plans" for options and related help.

Contesting Your Property Tax Assessment

Understanding the Assessment Review Process

If you believe your property's assessed value is too high, you have the right to challenge it. This involves filing a formal appeal with the NYC Tax Commission.

Filing an Appeal

The appeal process has specific deadlines and requirements. Document your reasons for challenging the assessment, such as comparable sales data or evidence of property damage. The DOF website provides detailed information on the appeal process and forms. Searching the DOF website for information about "nyc dept of finance property taxes assessment review" is an ideal approach.

Important Deadlines

Deadlines for filing assessment appeals are strict. Missing the deadline will prevent you from challenging the assessment for that tax year. Consult the DOF website for the current deadlines.

Video: NYC Property Taxes: What You MUST Know!

NYC Property Taxes: Frequently Asked Questions

Here are some of the most common questions about NYC property taxes. Understanding them can help you navigate the system more effectively.

How are NYC property taxes calculated?

NYC dept of finance property taxes are based on the assessed value of your property, not necessarily the market value. This assessed value is multiplied by a tax rate, which varies depending on the property class (e.g., residential, commercial). Exemptions and abatements can further reduce your tax bill.

What are the different property classes in NYC?

NYC has four main property classes: Class 1 (mostly 1-3 family homes), Class 2 (residential co-ops and condos), Class 3 (utility properties), and Class 4 (commercial properties). The tax rates differ for each class. Understanding your property class is key to understanding your tax obligations.

How can I challenge my NYC property tax assessment?

You can challenge your property tax assessment by filing a challenge with the NYC Dept of Finance and then, if necessary, the Tax Commission. There are specific deadlines and procedures you must follow, so it’s crucial to be aware of these timelines. Ensure you have sufficient evidence to support your claim.

Where can I find more information about NYC Dept of Finance property taxes?

The best resource is the NYC Department of Finance website. There, you can find detailed information on property tax rates, assessment processes, exemptions, and payment options. You can also contact the department directly with any specific questions.